How To Modify Your Home Loan

Purchasing a new home is exciting, but it's also an involved process that can take plenty of time, paperwork and money. even as you're wrapping up the transactions during the closing stage, there are associated costs. here's a look into wha. Understanding the best ways to modify your home loan requires financial expertise, especially when you’re facing a foreclosure. here’s a look at how to modify your home loan. Dcp enforces connecticut’s home improvement act, and administers the home improvement guaranty fund, which may provide assistance to homeowners who have a court judgement against a contractor who cannot pay them back for poor work. view the fact sheet cost to build 3 bedroom house nz and application to the home improvement guaranty fund.

Architects and engineers are taking a new look at ancient building techniques with modern designs. here's an introduction to the dirty little secrets. tomorrow's homes may be made of glass and steel—or they may resemble the shelters built b. After a lot of hard work and planning, house beautiful style director newell turner's house is finished, but the learning isn't. here newell shares 30 lessons he learned while building his house in the catskills. every item on this page was. Homeowners can apply for home improvement loans for a variety of reasons, including remodeling, updating or making repairs to their home. loans can be issued for anything as simple as a roof repair, an update to an energy-efficient furnace or a new addition. repayment for this type of loan can be made cost to build 3 bedroom house nz in many different ways.

How Do Home Loans Work

How Much Does A Steel Building Cost

If you are a diy-er, chfa understands that your dream home may not be move-in ready. fha 203(k) rehabilitation mortgages allow first-time homebuyers to take advantage of below-market interest rate loans that cover costs of purchasing and making full or limited renovations to your dream home. (860) 291-3600. rockville bank manc banks in downtown, hartford. 341 broad st. downtown hartford, ct. The minimum cost of building a house in nz. budget on $2500 per square metre for starters to get your mind in the right place. no, you can’t build a 300m2 home for $450,000 like you can in australia. yes, 180m2 might be a more realistic size for that budget. we had a client in 2018 build a 300m2 home for $2200/m2. Home equity loans. a home equity loan is a form of credit where your home is used as collateral to borrow money. you can use it to pay for major expenses, including education, medical bills, and home repairs. but, if you cannot pay back the loan, the lender could foreclose on your home. types of home equity loans. there are two types of home.

Cost Of Building A House Vs Buying Pocketsense

Don't be blindsided by hidden expenses. use these handy tips to estimate building costs for your new home, and learn tricks to saving money. the spruce / jackie craven it can be very difficult to estimate the cost of building a new home sin. Best home improvement loans in january 2021. as of saturday jan. 16, 2021. few homeowners could remodel their kitchen, build a backyard swimming pool or replace their roof without borrowing the. Packagers are encouraged to routinely visit the direct loan application packagers page for information and resources specific to packaging single-family housing direct loans. interest rates effective january 1, 2021, the current interest rate for single family housing direct home loans is 2. 50% for low and very low-income borrowers. Owning a home is a dream come true for many americans, and a federal housing administration (fha) loan can be cost to build 3 bedroom house nz a great tool for buying one. however, while fha loans are some of the best available for most potential homeowners, they do come w.

Repair loan packagers are not subject to the certified packaging process for purchase loans. information regarding the 504 packaging process can be found in hb-1-3550, chapter 3, attachment 3-a. allowable packaging fees to any public, tribe or private nonprofit organizations may be included in repair loans, but not repair grants. Homeimprovement contractor registration. under the connecticut home improvement act, an individual and/or business is required to register with the department of consumer protection if they are contracting with a consumer to perform work on residential property. Home improvement loans ct it is recommended for financing major one-off expenses, including home renovations or repairs, medical bills, repayment of credit card debt, or funding college tuition. the main reason to take out a home equity loan is that it offers a cheaper way of borrowing cash than an unsecured personal loan. by using your. The time has come when you are ready to own your own home. however, before you go much further you must make an important decision. do you buy a home, or do you build one from the ground up? while there are many considerations, one of the m.

Single Family Housing Direct Home Loans In Connecticut

A home improvement loan is an unsecured personal loan that you use to cover the costs of home upgrades or fixes. lenders provide these loans for up to $100,000 with rates typically between 6% and 36%. Americans spend more than $400 billion each year on home improvements and repairs. many companies featured on money advertise with us. opinions are our own, but compensation and in-depth research determine where and how companies may appear.

Tiny houses are small, but there’s a lot more to building one than just finding land and plunking down a prebuilt home on wheels. here are the steps to take. elevate your bankrate experience get insider access to our best financial tools an. According to the united states census bureau, the average price of a house in the united states in 1960 was $11,900 in 1960 dollars. when adjusted for infl according to the united states census bureau, the average price of a house in the un. Buying a home is probably the biggest purchase you’ll make in your lifetime, and you don't want to leave any room for error. getting it right means understanding the mortgage process, from start to finish. from what you need to do before bu.

Several state agencies provide loans for home improvements (i. e. rehabilitation and repairs). the quasi-public connecticut housing finance authority ' s (chfa) rehabilitation mortgage loan program is available to lowand moderate-income first time homebuyers using a chfa mortgage and for refinancing when repairs are necessary.

A smart-e loan offers no money down, low-interest financing with flexible terms to help you upgrade your home’s energy performance and save money! over 40 home improvement projects that reduce energy use and lower utility bill costs may qualify. with rates as low as 4. 49% applying through a local lender is as easy as child’s play!. Mainstreet breaks down the ways you can tap your home equity to finance a fixer-upper. new york (ratewatch) a home renovation project can be a great way to perfect your dream home (and add a bit of value to your property), but it doesn’t. A town program provides interest-free, deferred-payment home improvement loans for eligible homeowners. by ellyn santiago patch staff feb 10, 2020 2:22 p m et.

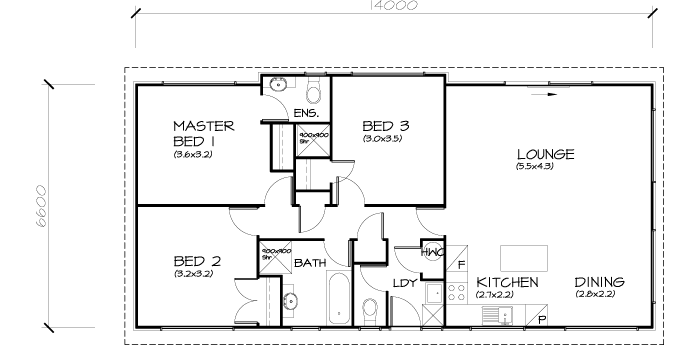

This is a rough guide to help you narrow down the type, and size of home you want to build. it's usually based on the simple 'hip' roof design and is a dwelling cost only, excluding council fees, watercare fees and site works needed to get your site ready to build on. They might also include options for tax credits, home improvement loans, discount programs and local incentives that can help you cover—or at least reduce—the cost of your projects. finally, if you’re in a designated rural area, you can also apply for a home improvement grant with the u. s. department of agriculture. these grants offer up. A home improvement loan is helpful if you don't have cash to pay upfront for home improvement expenses. home equity loans and personal loans are the most common types of home improvement loans, but there are other options, such as cash-out refinancing. banks, credit unions and online lenders may offer home improvement loans.